Solving Prompt Management

Why it happens: speed. Pilot pressure. The belief that prompts are just glue code. Fix it: build a prompt registry with version control, reviews, and rollback. Document assumptions inside the prompt as comments. Pair prompts with evaluation suites that run nightly: accuracy tests, bias checks, and cost-per-output drift.

For customer-facing automation, require a change ticket to modify any system prompt. It's DevOps for language. And it's non-negotiable if you care about revenue consistency.

Unmeasured Latency Tax

Every second in the funnel costs you. A 7–10 second delay for an AI-generated product recommendation? Users bounce. Agents waiting for a model to summarize account history? Hold music dilutes satisfaction and upsell chances. Latency is the hidden churn accelerator.

Why it happens: synchronous calls for tasks that should be staged or cached. Overly large context windows. Unoptimized embeddings and zero edge caching. Fix it: precompute where possible. Cache top recommendations by segment. Use streaming responses for long generations so users see progress.

The "Set-and-Forget" Fallacy

Markets change. So do models. Drift creeps in—new slang in support tickets, seasonal pricing quirks, a revised returns policy. If you don't retrain, realign, or at least re-evaluate, your AI gets quietly dumber while your competitors sharpen theirs.

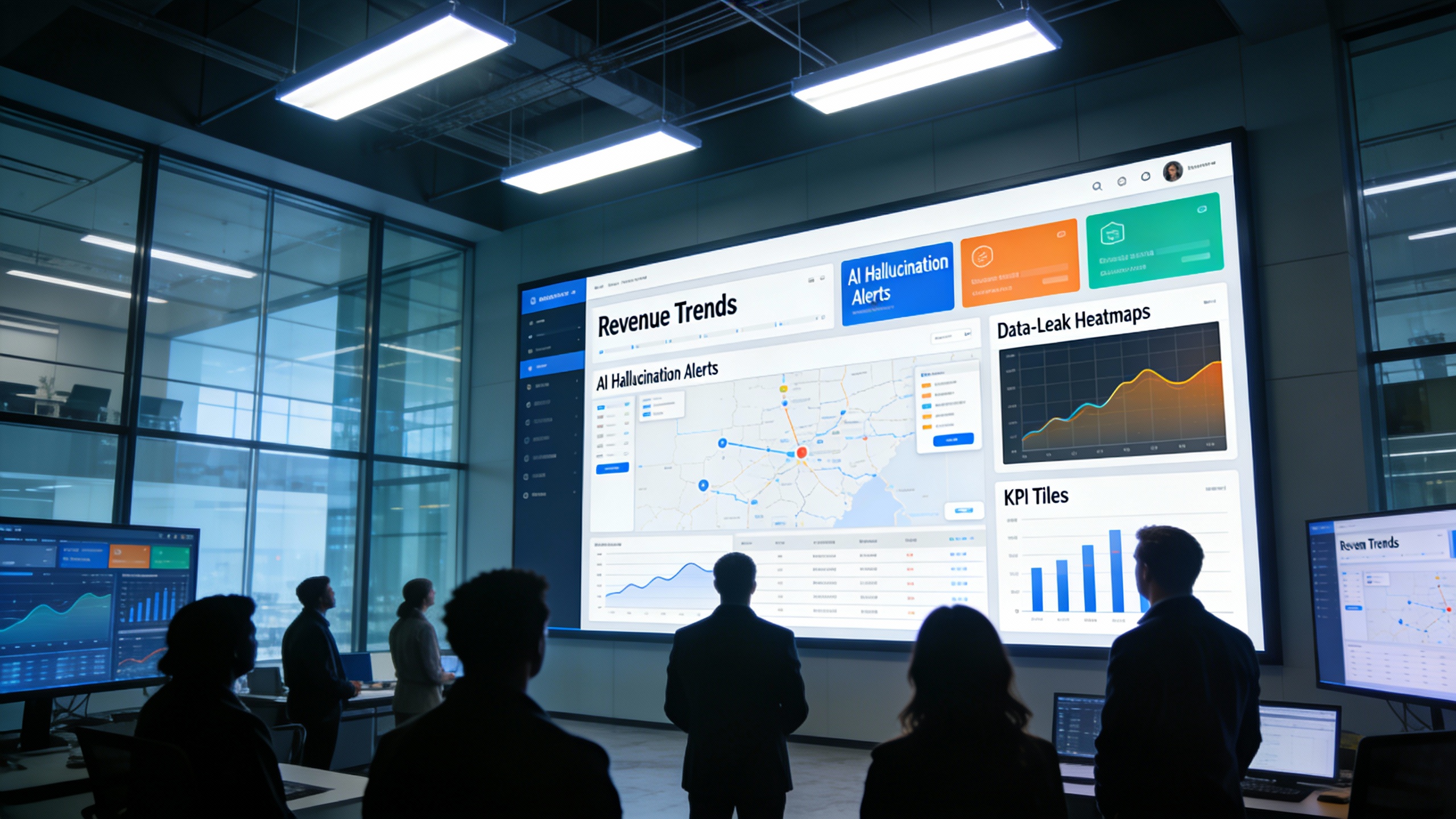

The 10 Mistakes Checklist

- Hallucinations unmanaged: no RAG, no citations, no cross-checks.

- Data leaks: PII in prompts, external training allowed, no red-teaming.

- Bad incentives: bookings over adoption, no stage gates, churn ignored.

- Model myopia: one model for all tasks, no routing, no SLAs.

- Prompt sprawl: no registry, no versions, no evals.

- Latency tax: no caching, no streaming, bloated context windows.

- Set-and-forget: no drift checks, no fine-tune cadence, no error replay.

- Synthetic without provenance: no watermarks, no bias audits, no rights tracing.

- Agent overreach: unlimited tools, irreversible actions, zero approvals.

- KPI theater: vanity metrics over causal revenue impact.

Building Revenue-Safe AI

The opportunity is massive. IBM projects a $9 billion AI-linked revenue run-rate by 2025, with analysts modeling bigger upside bands. That growth will belong to companies that pair ambition with discipline: crisp data governance, honest incentives, and automation that earns trust week by week.

Revenue-safe AI is designed, not discovered. Pick two flows with measurable revenue impact. Define decision rights, instrument metrics, stand up governance, and run pilots with holdout groups. If you need a centralized place to manage prompts, agent capabilities, and evaluation runs, platforms like EZWAI.com offer a workable spine.

AI can be your best seller and your cleanest operator. Or it can be a liabilities machine. The difference rests on whether you dodge these ten mistakes and build the boring scaffolding that lets the impressive stuff shine.